Are You Looking For an Affordable Auto Loan?

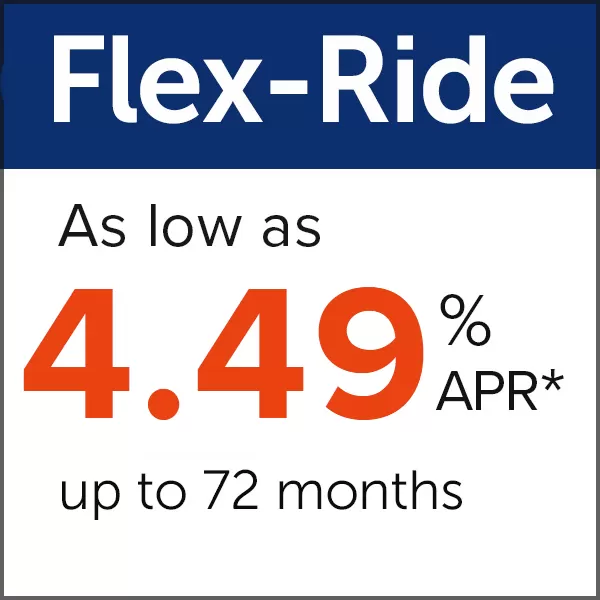

Take a look at our Flex-Ride Loan. Flex-Ride Loans offer leasing benefits like lower monthly payments plus the flexibility and power of ownership.

You turn a car back in at the end of a lease with no residual benefits. With the Flex-Ride Loan, you own the vehicle, allowing you the option to sell, trade, or pay off your balance at any time during the loan or at maturity. Or you can return the vehicle at loan maturity, and instead of paying the final balloon payment, you walk away with no end-of-loan term hassles.

A Flex-Ride Loan gives you the best of both options. Other great features include:

- Flexible terms 24 to 72 months

- Actual ownership

- Finance new or used vehicles up to 5 calendar years old

- No or low down payment - taxes and registration fees can be included in the payment plan

- Trade, Sell, or Refinance at any time

- At loan maturity: Trade, Sell, Refinance, or Return the vehicle and walk-away

- No pre-payment penalties or early termination fees

- Mileage plans for various driving habits - select 7,500, 10,000, 12,000, 15,000 or 18,000 miles per year

- Easy upgrade every couple of year

*APR is Annual Percentage Rate. The Base Annual Percentage Rate is the lowest rate offered and can vary based on credit worthiness, relationship level, age of vehicle and terms of the loan. Your rate can be higher depending on credit performance; financing up to the retail value of the auto is available. Rates are subject to change without notice. For example, monthly payments for a $20,825 Flex Ride loan (which includes an $825.00 program fee) for 36 months at 4.49 %APR would be $351.26 a month for 35 months; and a payment of $10,664 for the 36th month.

Go to main navigation