Jerry Erickson Scholarships Applications Available Now

We're excited to share that the Jerry Erickson scholarship application period is now open! If you or someone you know is pursuing higher education, this is your chance to apply for educational funding to make a real difference.

Scholarship applications can be downloaded here and must be mailed with a postmark no later than March 2, 2026. We encourage you to take this step toward realizing your dreams - because we're proud to stand behind you wherever you are on your journey. Welcome to the Northland.

Click for more info.

NAFCU Begins Oscoda Rennovation

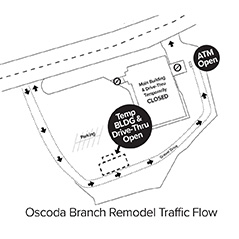

Construction has begun on the Oscoda branch remodeling project. Until construction is finished, please use our temporary lobby and drive-thru located in the parking lot. This Banking Services building will be open during our regular hours.

To maintain safety during construction, we have established a temporary change to traffic flow. Click here to open the map.

While we love seeing you, our members’ smiling faces, we wish to remind you of the many convenient tools available in our digital banking platform.

Thank you to everyone affected, and we appreciate the cooperation and patience needed as we upgrade our facilities with the latest technologies at our branch in Oscoda.

CashBack+ Rewards

Northland has partnered with Prizeout to offer a marketplace for members to purchase digital gift cards from national retailers like Amazon, Home Depot, Walmart, Starbucks, and more. Browse personal offers where you can receive up to 20% instant cash back! All you need is a Northland checking account and digital banking. Download the CashBack+ Pay app on the App Store and on Google Play! Watch our tutorial on how to get started in 5 quick steps here.

NOVA

When members call Northland Area Federal Credit Union for assistance, our Outstanding Virtual Assistant, known as Nova, can quickly help them with requests or find answers to their questions. Nova is replacing CORA, Northland’s Courteous, Optional, Reliable, and Available telephone service. Nova can help you with everything that CORA can do.

What Can Nova Help You With?

- Account Balance

- Deposit Status

- Money Transfer

- Transaction History

- Routing Number

- Apply for a Loan

- Loan Rates

- Savings Rates

- Branch Hours

- Sign-up for E-Statements

Nova is NOT CHATGPT enabled and will not be replacing any of our Contact center employees. When Members call to speak with Nova, their information will not be stored. Members’ personal information is masked for their privacy.

Business ACH Payroll

Northland proudly serves Northern Michigan businesses with our unique and customized Business ACH Payroll Origination Program. The only financial institution in the area that utilizes enhanced Business Home Banking services to easily direct deposit payroll to your employees. Here are some benefits:

- Easy to use: Very user friendly and convenient, utilizes your existing Northland Business Home Banking. Simplified input screens for manual entry or QuickBooks upload compatible.

- Secure: Individual login’s and permissions for payroll staff to access the programs.

- Bottom-Line Savings: Low monthly cost, no more cutting checks or unnecessary wires. Simply direct deposit payroll to your employees.

- Local Support: Northland is your trusted provider for cutting edge digital services with inperson, on-site training to get you started.

Northland Saves Members over $1,000,000 with Flex-Ride

We're pleased to tell you that Northland members who financed new or used vehicles with Flex-Ride over the last year have saved $1,068,243.84 in payments over the life of their auto loans. "These aren't just numbers on a spreadsheet—these are real dollars that our members can redirect back into our communities to purchase groceries, pay bills, fill up their gas tanks, invest in local schools, support small businesses, contribute to charities, and so much more," said Jessica Richards, VP of Lending for Northland.

Flex-Ride Loans offer leasing benefits like lower monthly payments plus the flexibility and power of ownership. You turn a car back in at the end of a lease with no residual benefits. With the Flex-Ride Loan, you own the vehicle, allowing you the option to sell, trade, or pay off your balance at any time during the loan or at maturity. Or you can return the vehicle at loan maturity and, instead of paying the final balloon payment, walk away with no end-of-loan term hassles.

Flex-Ride offers flexible terms of 24 to 72 months, on new or used vehicles up to 5 calendar years old. No or low down payment, include taxes and registration fees, trade, sell, or refinance at any time. At loan maturity: trade, sell, refinance, or return the vehicle and walk away, no pre-payment penalties or early termination fees. There are mileage plans for various driving habits. Let us help you get into your next auto. Talk to us today!

Trust & Will Member Savings

Protect your family and secure their future with an estate plan. Members can get exclusive savings of 20% off any estate plan with Trust & Will.

Don't Be a Target for Fraud

Romance Scams? They might sound ridiculous, but they happen! Our newest commercial highlights the dangers of these scams and gives you the information you need to protect yourself and your finances. In today’s cyber world, anyone can be a target.

Oscoda Branch Upgrade

Northland is pleased to announce that our Oscoda Branch will be getting an upgrade! Coming soon, Northland will be making substantial improvements to the Oscoda branch. These improvements provide space for a new and refreshing branch, complete with teller pods, several private offices to meet with members, and a new drive-up area suitable for a variety of vehicle sizes. Stop by the Oscoda branch today to see the vision. Pictured is Pete Dzuris, CEO, and Katie, MRR; Sara, Assistant Branch Manager; and Kay, MRS.

Go to main navigation